This week we want to discuss the recent decision by the Biden administration to release approximately 180 million barrels of oil from the Strategic Petroleum Reserve – why are they doing this, what will be the impact and the potential risks involved.

So what is the Strategic Petroleum Reserve (SPR)?

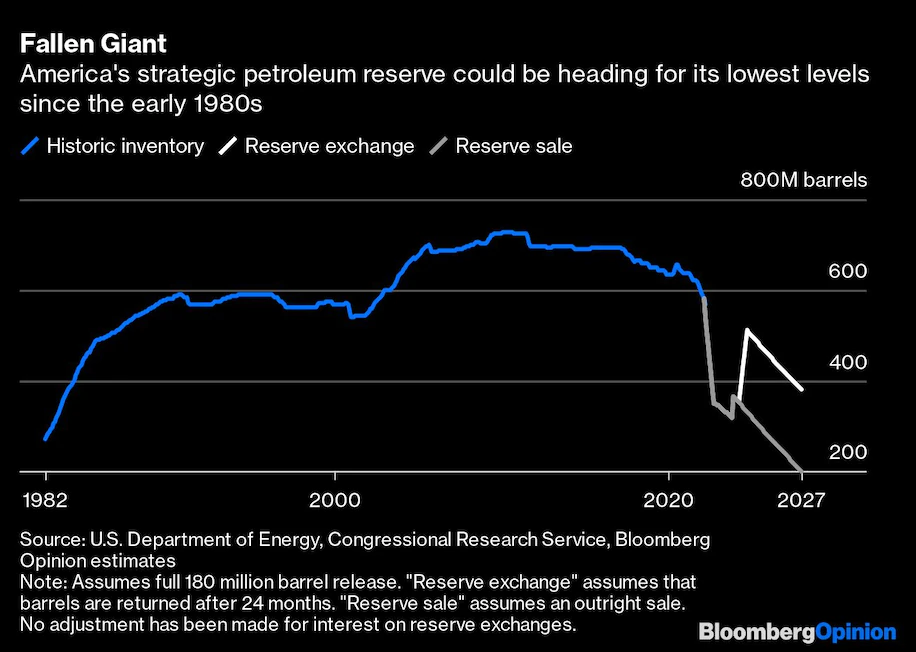

The SPR is the world’s largest supply of emergency crude oil and is operated by the US Dept of Energy. This emergency oil system was created in the 1970s after middle eastern oil producers imposed the oil embargo. The system is capable of storing up to 713.5 million barrels of oil and as of March 31st held 570 million barrels. The SPR is capable of releasing crude oil into the markets within 13 days of a Presidential request but has only been asked to sell its oil three times since its creation.

Why are they doing this?

The administration is under a lot of political pressure to reduce gasoline prices in the US. Recent polling has noted rising fuel expenses as a key issue going into this year’s mid-term congressional elections. In the past year, wholesale gasoline prices have increased nearly 70% pushing the odds of Republican control of congress to 72%.

The White House is a bit stuck. Their core supporters and donors are against continued fossil fuel usage but the recent increase in energy costs is pushing their unfavorable ratings over 52%. By releasing oil stocks from the SPR, they are hoping that they can drive down gasoline prices over the next six months and win back some political support for the coming elections in November.

What will be the impact?

They are proposing to release an enormous amount of oil from the SPR. At 180 million barrels, this would be the largest release in history and 3.6x larger than the next largest release. Since the announcement, WTI Oil prices have dropped by 11% to $100 per barrel. It is hard to say if the SPR announcement was the driver of the price decline given the very high volatility of oil prices this past month.

The White House said, “This record release will provide a historic amount of supply to serve as bridge until the end of the year when domestic production ramps up.” At least publicly, they are expecting producers to increase supply in spite of competing with them with the SPR. To understand the intermediate to long-term impact of this release on the oil market, we need to know what oil companies are thinking and if the administration is right about them increasing supply.

A good tool for this type of analysis is the Dallas Fed Energy Survey which provides industry insiders’ views on a host of fundamentals of the energy markets.

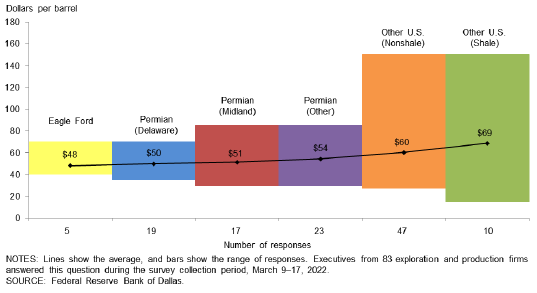

According to this survey, the majority of firms are expecting WTI Oil prices to be $80-100 through the end of the year with the survey average price of $93.26. The most important issue for firms deciding to bring on new supplies is profitability of course. If they are right and oil prices stay around $90 per barrel, then profits should be very healthy. When asked at what oil price is your firm profitable, the average answer was $52 per barrel.

At $38 profit per barrel, new supply should be coming on very quickly, but it isn’t. The survey respondents estimated that supply will grow by only 6% this year. As a follow up question, these firms were asked at what price would energy producers commit to increasing supply. The answer was shocking—30% said a price above $100 per barrel and 30% said that the decision to bring on new supply was not price dependent.

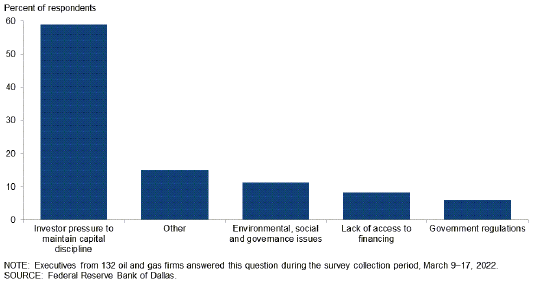

When asked for the primary reason oil producers are restraining growth despite high oil prices, nearly 60% said they were under severe pressure from investors to maintain capital discipline.

Evidently the industry has been burned too many times chasing high prices that eventually led to a severe downturn. So if most domestic producers don’t see supply growing that much this year in spite of very high prices, the SPR release will most likely have no meaningful intermediate to long-term impact. In fact it might even delay or reduce supply increases as the SPR release temporarily reduces prices.

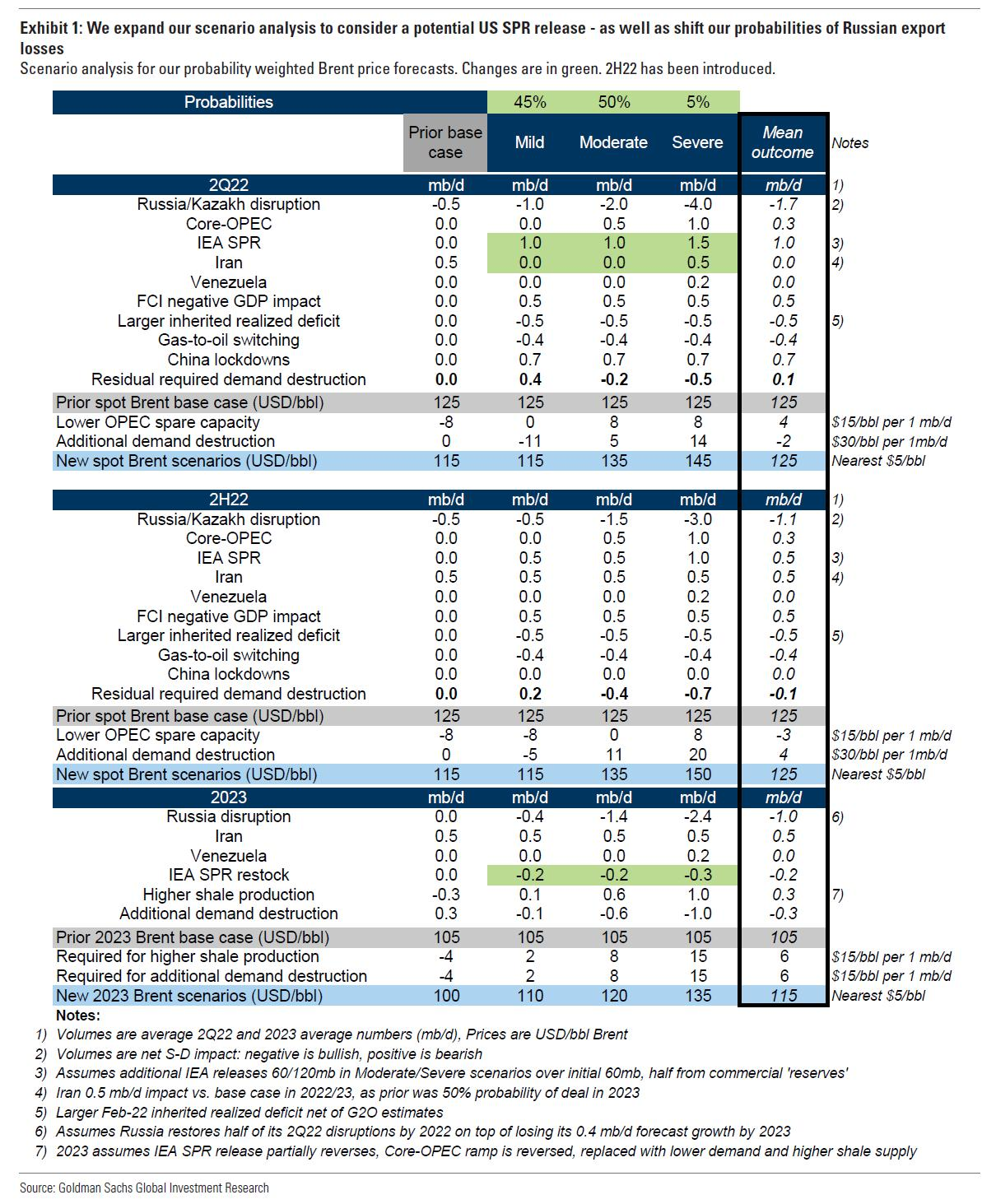

Goldman Sachs updated their oil forecast scenarios to account for the SPR announcement this week.

They are estimating no change to their mean Brent oil price of $125 per barrel through 2022 and are actually increasing their 2023 mean price by 10% as the short-term impact of the SPR release leads to a worsening intermediate-term supply situation.

What are the risks?

After finishing this record SPR release, the reserve will be at only 55% capacity. This could put the US in a dangerous situation if a real supply crisis were to occur before the reserve can be replenished. In the meantime, China is actually adding oil to its reserve system with large purchases of Russian oil at steep discounts.

OPEC is also not happy about the announcement. If OPEC decides to reduce supplies as retaliation to the US policy, once the release is completed we could be in a much worse supply situation than we are today.

Overall the SPR release is a big gamble that short-term supply can relieve voters of high gas prices, incentivize domestic oil production and not offend OPEC nations. For now evidently the political math says go for it.