This week we want to highlight the US banking system and the potential for good long-term returns in this space. While many sectors of the stock market have shrugged off fears of recession, the large banks continue to trade at depressed levels. Since their peak in late 2019, these stocks are down 36% and trade at prices to book value and earnings at reasonable levels. In the past month, this space has fallen 21% as investors shift their assumptions on the depth and duration of the recession. This week was particularly painful for these companies as the Federal Reserve changed some regulations limiting their ability to payout dividends and buyback their own stock. Today the KBW Banking index fell 6.4%. For us these critically important companies are becoming more attractive as prices fall and regulators act to insure their long-term health.

The large sell off in the bank stocks is being driven by three main fears:

- The fear of large and growing loan losses

- The fear of regulatory intervention

- The fear of negative interest rates

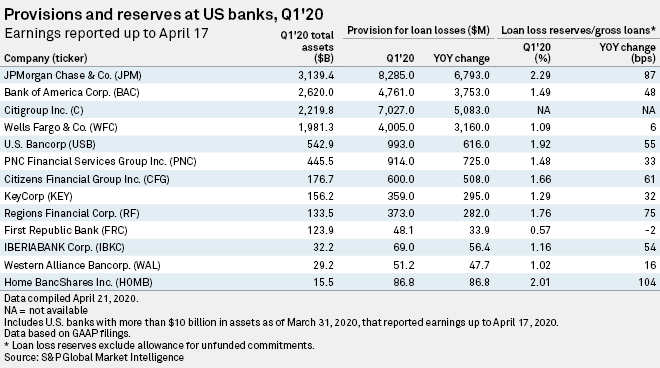

Let’s briefly address each of these fears. First, the banks are going to experience large and painful losses on their current loan portfolios. In the first quarter, the banking system took billions in provisions for loan losses meaning they wrote down their loan assets based on their assumptions of default. These assumptions are driven by unemployment, collateral values, etc… The largest banks wrote down or reserved over $21 billion in the first quarter.

We expect more provisions for losses in the second quarter based on higher default rates on auto, home and commercial loans. However, banking is designed for these cycles of gain and loss. What is important for a bank shareholder is does the bank have enough equity capital to get past the losses without raising new capital which will permanently impair or dilute the current shareholders. During the financial crisis, banks had very low equity capital buffers and suffered serious losses which required large new capital raises. This time the banks are better capitalized thanks to laws implemented after the last crisis. Banks today have half to a third less leverage than they did in 2008. Given a better credit profile in consumer debt, mortgages and auto loans, we belief the large US money center banks will have enough earnings and capital to make it through this recession without the enormously dilutive capital raises of 2009.

Second, the regulators will intervene to stabilize the banks. That is their job and no one wants a bailout repeat of 2009. This week the government put caps on bank dividends and banned share buybacks for a time in order to preserve capital inside the banks to absorb losses. While the bank stocks sold off on this news, we view it as a long-term positive as it will prevent excess capital from leaving just as it is needed to cover losses. We’d rather see healthy bank balance sheets instead of short-term dividends as shareholders.

Finally, negative rates are scary for a bank but the absolute level of rates isn’t the driver of bank profitability, but the slope of the interest rate curve. Banks borrow money short-term or at the short end of the curve and lend money long-term or at the long end of the curve. So if long-term rates remain positive the banks can still make healthy profits over time. Currently there is a positive spread of 50-70 bps in the interest rate curve. Banks can also manage their returns on equity by varying the way they make money. US banks are not solely reliant on interest rate differentials. They are very good at making money from other sources like underwriting fees, consumer fees, credit spreads, managing expenses and varying funding sources. We expect them to be able to earn sufficient funds to maintain healthy capital balances during this recession. So assuming that the banks have enough capital to make it through the recession, valuations on these stocks have become attractive relative to the rest of the market. Based on consensus operating earnings per share estimates, the KBW Bank Index is trading a bit over 13x the next twelve month earnings estimates versus nearly 24x for the broad stock market. The major banks including Bank of America, Citibank and Wells Fargo are trading at prices less than their book value (their asset value) which historically has been a good time to invest in this industry. We have just begun our deep dive into this sector, but are optimistic on the opportunity for solid long-term returns in this space.