This week we want to briefly discuss a topic that many people have been asking about – Inflation. This is an enormously complex topic with so many moving parts, so we can’t really do it justice in a Weekly Thoughts note. If after reading this letter you want to discuss this topic further please reach out to us and we’d be happy to talk in more detail.

For those of you who lived through the inflationary period of the 1970s, the word inflation conjures up many emotions, most of which are negative. So its understandable that so many people are now worried that we might be on the cusp of another period of painful inflation. When we see the Federal Reserve purchasing trillions of financial assets and the federal government running multi-trillion dollar deficits the natural assumption for most people is that they must be printing money and that means we’ll get inflation. Well, not so fast. There are just as many examples of deflationary environments as inflationary when governments go down the path of quantitative easing and deficit spending—see Japan and the European Union for examples.

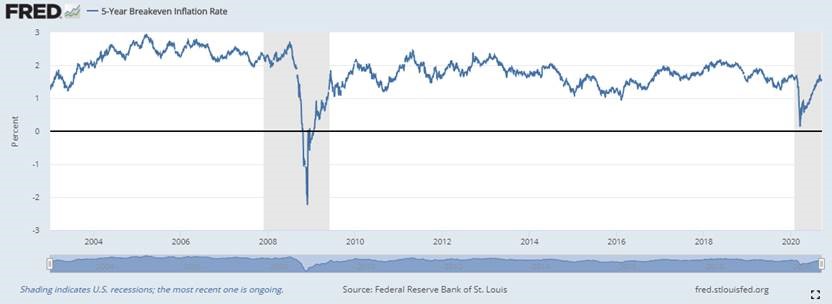

Unfortunately right now many markets disagree on the likelihood of inflation. If you monitor the gold or other precious metals markets, it would appear that inflation is imminent. Those markets were just as convinced in 2010 and 2011 that inflation was about to explode higher. It didn’t happen. The largest market on earth whose sole concern is future inflation expectations – the US bond market—is less sanguine on the risk of inflation. Inflation expectations in the bond markets are tracked using the “Breakeven Inflation Rate”. This rate is the variance between the fixed yield and the inflation adjusted yield of matched maturity treasuries. Currently the 5 year breakeven inflation rate is about 1.5%. This means that the bond market is expecting inflation over the next five years to average about 1.5%. This is right around average over the past couple of decades.

The Federal Reserve has recently confirmed their intention to try to push average inflation to 2% per year by allowing short-term rates to stay low for an extended period. This is not new. This has been their stated goal since the financial crisis. If you remember, fed funds rates were set at 0% for nearly nine years and we saw average inflation of about 1.5% for nearly a decade. Central banks have a very, very poor track record of being able to control the rate of inflation. Why, because inflation is driven by more than just the interest rate and amount of money being pumped into the economy.

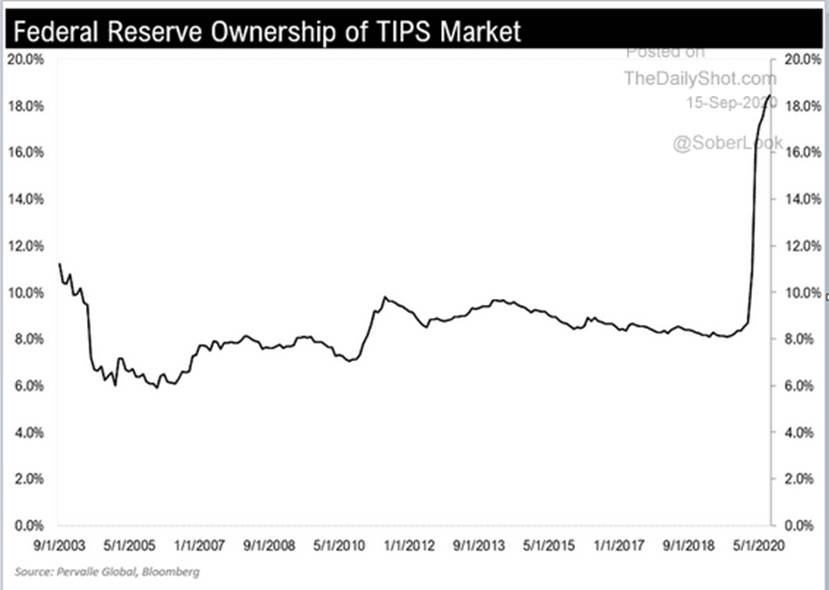

We’ll get to a couple of those other drivers soon, but first we want to highlight that the breakeven inflation rate may be overstated today. Yep, you read that right. We think there is a good chance that the market may be expecting lower rates of inflation than 1.5% over the next five years. Why? Well, the central bank is actively involved in driving up the current breakeven inflation rate. How can they do that you might ask. Remember, the breakeven inflation rate is just the difference between the fixed yield and the inflation adjusted yield. If they were to buy a massive quantity of inflation adjusted bonds, they could push the inflation adjusted yield lower than it might otherwise be, thus overstating inflation expectations. Well are they doing that? YES.

Since March, the central bank has been buying massive amounts of TIPS (Treasury Inflation Protected Securities). They have more than double their holdings of these inflation adjusted bonds. They now control over 18% of the entire TIPS market meaning that investors are no longer setting inflation expectations—the Fed is. We are not saying the Fed is setting what actual inflation will be, but what the bond markets are saying they expect inflation to be. So given this manipulation, we would bet that actual inflation expectations by real investors may be much lower than the current implied 1.5% over the next five years.

But, but, but they are printing money so inflation must go higher – says every gold investor. Well not necessarily. During the 1970s inflation period, the real money supply actually fell by 13%. In spite of this contraction in the money supply, inflation averaged over 7%. In the decade after the financial crisis, the real money supply increased by 61% but inflation averaged under 2% (you now see the Fed’s frustration). There isn’t a great correlation between the money supply growth rate and the inflation rate. Other factors wield enormous influence over inflation.

Two of those important factors are debt and demographics.

First let’s talk about debt. In the short-term (a year or so) increasing debt levels may cause rising prices if production levels are not adjusted to the new level of spending. However, over the long-term, debt is a deflationary force. As debt levels rise, the cost to service and repay the debt reduces discretionary income. This is why central banks suppress interest rates. They are attempting to offset the deflationary impact of debt servicing costs. During the 1970s, total debt to GDP grew from 147% to 160%. Actually not that much of an increase. This mild rise in aggregate debt didn’t inject much of a deflationary force into the economy. Since then total debt has exploded higher. At the peak of the financial crisis, total debt to GDP reached 380%. This is an enormous amount of debt. This debt load was a major cause of suppressed economic growth and inflation over the last decade in spite of central bank attempts to stimulate through quantitative easing and zero interest rates. In 2009, total debt was about $55 Trillion. As you might expect given a decade of cheap debt, total debt now stands at a whopping $79 Trillion. So an increase of almost 44% in total debt since the last financial crisis. This level of debt is a real contributor to deflationary forces in the economy.

Finally there is demographics. We are getting older. Not just you and I, but the entire country (and for that fact the entire world). Not surprisingly age has a large impact on how much money people spend. A study by the US Bureau of Labor Statistics has shown that household spending peaks between the ages of 45-54. That seems reasonable for anyone with teenagers. Between the ages of 25 to 54 household spending increases on average by 26% in total. So a young and growing population consumes more each year. If aggregate production doesn’t keep up with this surging demand then prices rise causing inflation. This was very noticeable during the 1970s. The very large baby boom generation was entering the workforce, starting families and consuming. The supply of houses, cars, food, etc. couldn’t keep up so we saw a real inflation problem until that cycle was broken by high interest rates (suppressed consumption) and more production capacity. Today we have the opposite problem. Our economy has been built to supply enormous quantities of stuff. The baby boomers spent a lot and borrowed even more (as noted above). The economy responded by installing a lot of production capacity to meet the demand. Now, however, the baby boomers are getting older. The same USBLS study noted that between the ages of 55 and 75 average household spending declines by 44% in total. This is huge. An aging population obviously consumes less each year. In 1970 the median age of the US was 28. It is now 39 with nearly 30% of the population over the age of 55. We now find ourselves in a demographic trap. We have an economy built to supply a lot at the same time we are demanding less stuff as we age.

These two issues of large debt levels and an aging demographic have created significant deflationary forces in the economy. We aren’t alone. Japan and Europe are in a similar predicament but at least there no one is brave enough to forecast high inflation rates.

To sum up this very complex topic: the bond markets are forecasting mild inflation for many years that actually may be overstated due to central bank manipulation. Our levels of debt and demographic profile have created a natural deflationary environment which the government is desperately trying to combat with quantitative easing and suppressed interest rates. High inflation might be a risk if the central banks lose the confidence of the markets and the populace, but we think it is more likely that over the next five years inflation remains at levels we’ve experienced over the past 20 years.

Many people are very concerned about inflation and its impact on their life. As we mentioned earlier, we are happy to have a more in-depth discussion with you on this subject—just give us a call.