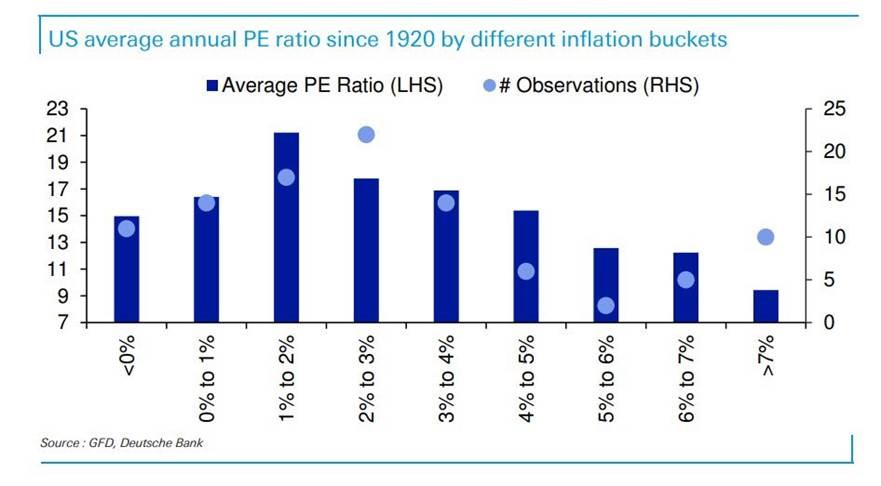

We’ve had some interesting discussions about inflation this past week and wanted to share a bit more on this topic. This week we want to discuss the impact of inflation on stock prices and returns. Many assume without looking at the historical record, that stocks are a great hedge against inflation. On the surface it makes sense. Companies should be able to increase prices, thus insulating themselves from the increase in costs. What this thinking doesn’t incorporate is the multiple paid for those earnings is very sensitive to inflation expectations.

As you can see, the Price to Earnings ratio (PE) of stocks is strongly correlated with the inflation environment. For the last decade we’ve been living in the sweet spot for PE ratios with an average inflation of between 1-2% annually. Historically, average PE ratios have been at 21x in this inflation zone. However, as inflation leaves the sweet spot, PE multiples compress. When economies are contracting or are faced with deflationary environments, PE multiple fall to an average of 15x. The same occurs when inflation is running between 4-5%. When inflation really starts to accelerate, stock PE ratios collapse. This has historically been driven by rising interest rates and an expansion in the equity risk premium to account for the uncertainty.

So companies could theoretically grow earnings as expected during an inflationary period but that growth doesn’t offset the discount the market applies to the stock price.

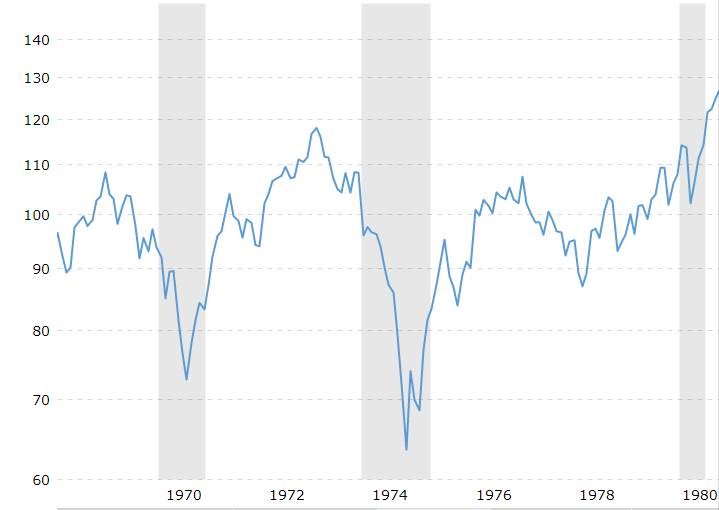

Let’s take a look at what happened during the 1970s as an example. Between 1969 (the peak of the nifty-fifty period of the market) and 1980, S&P earnings grew by about 172%. That’s pretty impressive considering inflation averaged over 7% during that period. Companies were able to offset their rising costs and capture higher earnings. But stocks had a dreadful decade.

S&P 500 Nominal Price

Over that period from ’69 to ’80, the S&P 500 was basically flat with a lot of volatility. Even with a massive surge in profits, the market didn’t make any money. This was because the PE ratio of the market fell from 18.5x in 1969 to 6.8x in 1980. While the decade ended up flat, there were some very large drawdowns. During the 1974 recession, inflation spiked to almost 11% but the market fell nearly 50%.

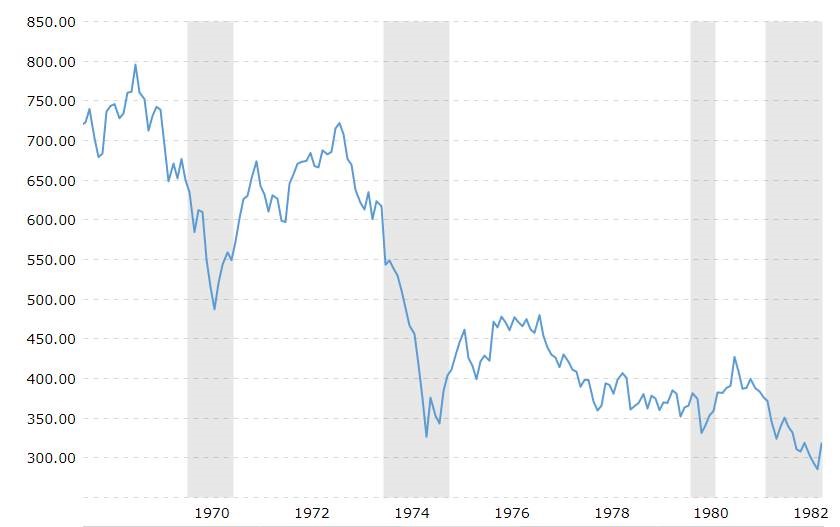

Looked at on an inflation adjusted basis, you can see how poorly stocks did during this inflationary environment. Purchasing power in the stock market fell 65% from ’69 to ’82.

S&P 500 Inflation-Adjusted Price (2020 Base)

So while it may seem counter-intuitive, high inflation is pretty bad for the stock market.

Last week, we highlighted that the bond markets are expecting relatively low and stable inflation over the next five years. It would also appear that the stock market agrees, considering the very high PE multiples currently embedded into stock prices.