This week we wanted to discuss a topic that has been on the mind of some of our clients. Qualified Opportunity Zones (QOZs) and 1031 Exchanges. Quite simply, these two vehicles are methods of deferring, reducing, or eliminating capital gains that would otherwise have to be paid. These vehicles should be considered when there is any event that triggers a significant capital gain for a client (most commonly a business, real estate, or investment sale). We have had some investors ask about and participate in these this year.

While you may have heard of these tax strategies, we find that many people believe the only way to participate is to make and manage these investments themselves. This is often inconvenient. The average person is not an expert in selecting and managing real estate investments (which these tend to be). Nor does everyone want to make a non-diversified, (usually) large investment, in a single property.

It is possible, however, to invest in a fund that takes advantage of these strategies but invests in multiple properties across the country to provide diversification. In addition, these funds are managed by institutional real estate investment firms that do all the legwork in selecting and transacting in attractive properties, making sure the tax code is properly followed, and handling ongoing property management.

We have established relationships with several of these firms, and this allows our clients access to some of these funds.

A note: these fund investments are mostly for accredited investors only and have certain income and net worth requirements.

1031 Exchanges

The first “like-kind exchanges” were created by congress in 1921, but since their creation there have been several changes and amendments that have shaped the exchange process and requirements.

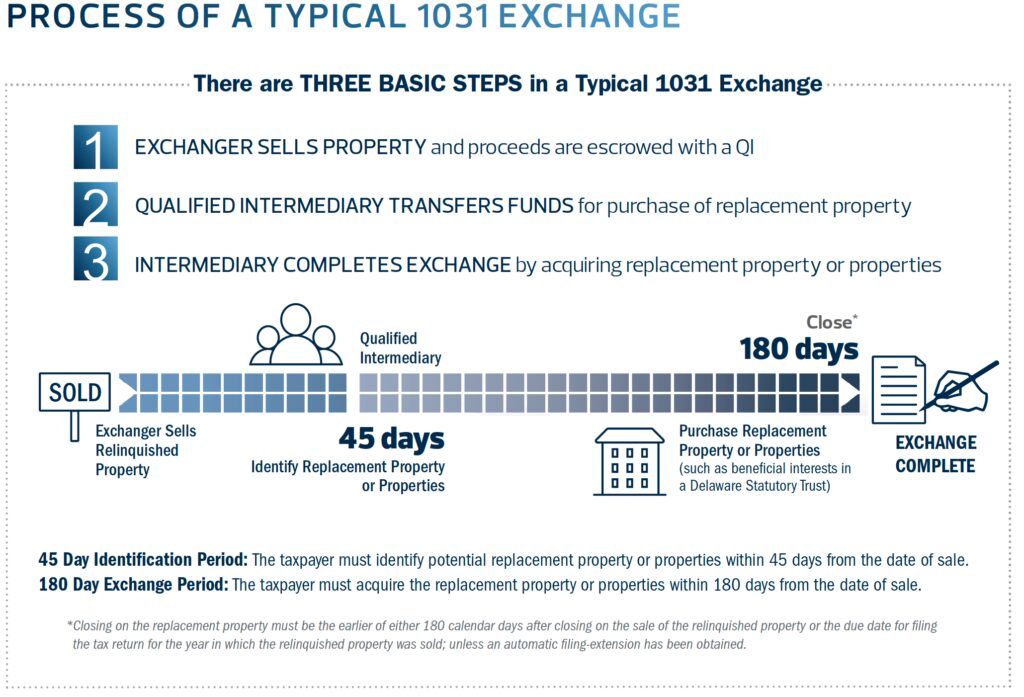

A 1031 exchange is a tax rule that allows you to sell one property and defer the taxes you owe on this sale, as long as you buy another property with the proceeds. If used correctly you can rollover the sale amount from one property completely into the other without triggering a tax event. Effectively deferring the entire capital gain until you actually convert the property to cash. There is no limit on how many times or how frequently you can do 1031 exchanges. The rules can also apply to a former primary residence under very specific conditions.

The following chart does a good job of capturing most of the rules and timing surrounding 1031 exchanges:

Source: Bluerock

Main takeaway: Defer the taxes owed after you sell a property, potentially indefinitely, by purchasing another property.

Qualified Opportunity Zones (QOZs)

The Tax Cuts and Jobs Act of 2017 created QOZs to encourage investment in economically distressed areas across the U.S. by giving tax benefits to these investments.

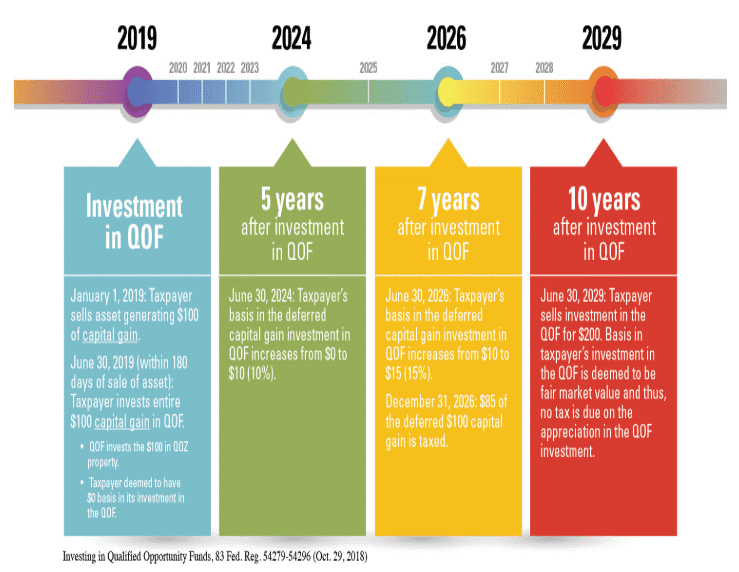

Any capital gains that are placed in a QOZ investments can be deferred and even reduced. Furthermore, if the QOZ is held long enough, the taxpayer will not pay any taxes on the gains from the QOZ investment itself.

In order to qualify, a taxpayer can simply take any capital gains they have, whether from real estate, a business, stocks, bonds, etc. and invest them in a QOZ fund. The capital gains are not owed until the earlier of 2026, or the date the QOZ investment is sold. Additionally, if the investment is held for 5 years or more, these capital gains are reduced by 10%.

Finally, if the QOZ investment is held for 10 years or more, any capital gains from the QOZ investment itself, will be tax-free!

The chart below does a good job summarizing such an example.

Source: The City of Lowell

Some important points to note:

- Short or long-term capital gains from any source, not just real estate proceeds, can be used

- You only need to invest the capital gains, not the entire proceeds of the investment (unlike the 1031 Exchange)

- You have 180 days from the sale of the asset to make the QOZ investment

Main takeaway: Defer and reduce the taxes owed on any capital gain, by investing those gains in a QOZ investment. The subsequent QOZ investment gains are tax-free if the investment is held long enough.

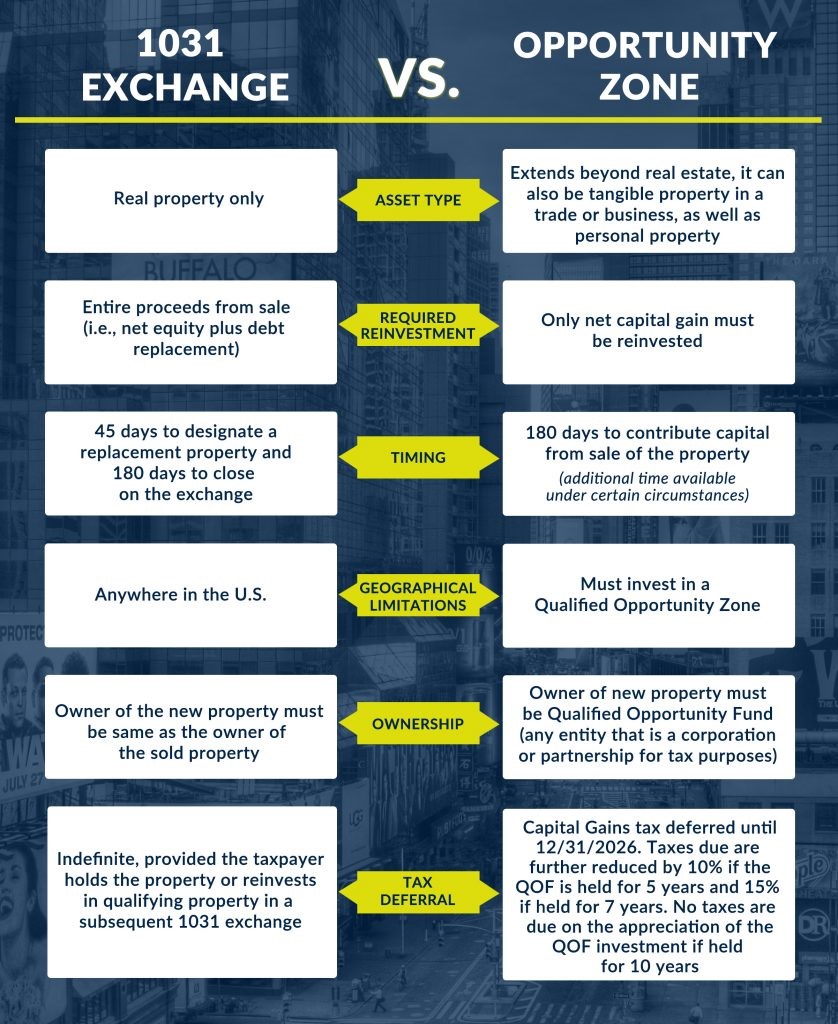

Similarities/Differences

Source: Progress Capital

These can be fairly nuanced, and the above information is really just scratching the surface, so please don’t hesitate to reach out if you have any questions or would like to dive deeper into these.