Normally at this point in the economic cycle, investment managers would be transitioning fixed income portfolios to more risky investments in junk bonds. This week we would like to highlight why we haven’t done that and discuss the current risk reward in the junk bond market also known as High Yield Bonds.

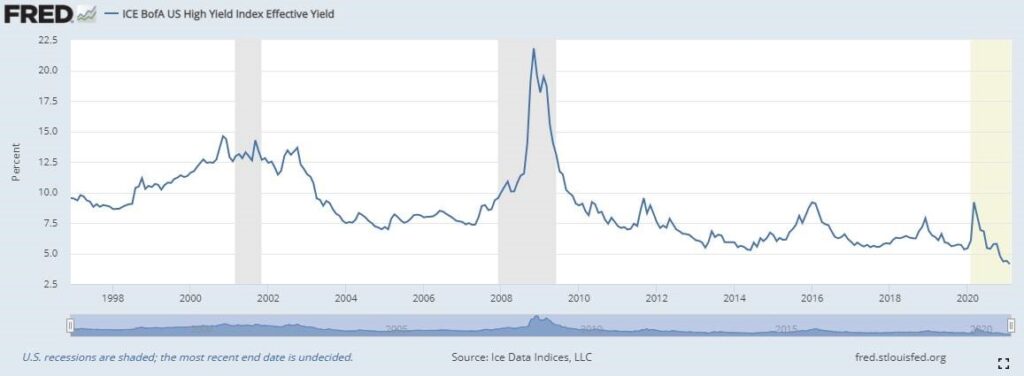

For bonds that have credit risk (the potential for default), you receive the prevailing treasury interest rate plus a premium for risk known as spread. These two components add up to the effective yield. Presently the US High Yield Bond Index (junk bonds or bonds rated below BBB-) is providing the lowest yield in its history. The two largest ETFs that own junk bonds are yielding 3.5% and 3.7% respectively. When compared to 0.5-1.0% on treasury bonds, this may look attractive, but junk bonds default and your expected returns must account for default expectations.

During 2020, 7% of issuers defaulted in the junk bond market. Each default lowers the actual return investors receive on their investment. At current yields, the market implied default rate for 2021 is just over 2%. That is a default rate most common during a post-recession recovery phase. So the market seems to think that junk bonds will follow a normal recovery cycle with lower defaults. We disagree with this assumption.

Usually during a recession, the weakest and most indebted companies default in mass. The market takes the hit and works through the bankruptcies. Then as the recovery begins only the strongest companies remain leading to a healthy junk bond market until the next crisis. This time the central bank prevented that cleansing from happening. In March of last year, they intervened in credit markets to prop up weak companies from defaulting. You can see in the above chart that during the last two major recessions, defaults reached 14% of issuers. This time we only reached 7% leaving many weak companies or “zombies” (companies that earn just enough money to continue operating and service debt but are unable to pay off their debt). Most of the companies that did default were in the energy sector but many of the weakest consumer services companies survived. In fact these weak companies have been able to borrow even more over the past twelve months.

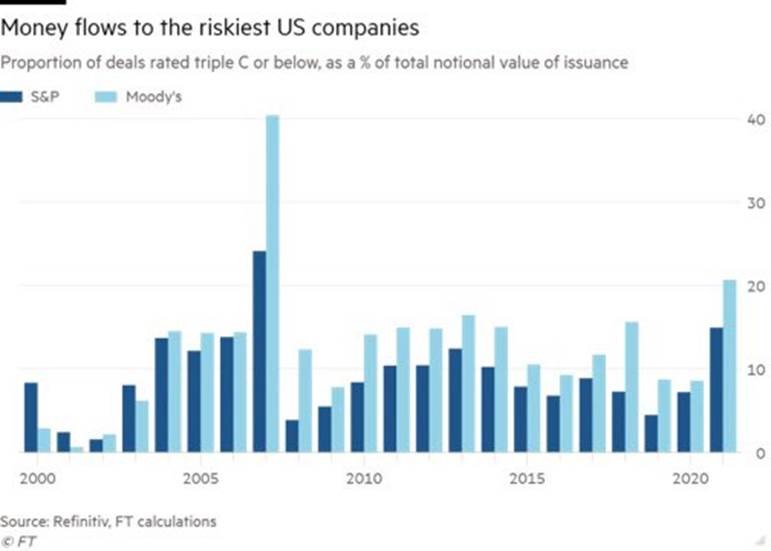

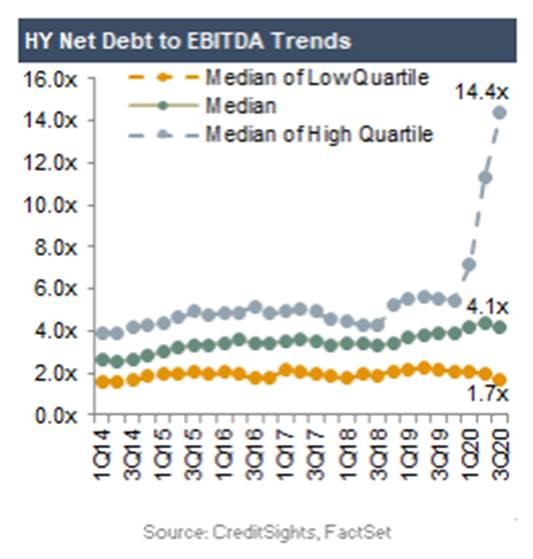

Recently the percent of new borrowing by CCC rated firms (the riskiest companies) reached 20% of all new loans in the junk bond market. The last time we reached that level of CCC issuance was right before the junk bond market crash in 2008. Another very worrying data point is the embedded leverage in the junk bond market. Usually after a recession, after the weak companies (the ones that borrowed too much) default, leverage in the system declines. Leverage is the ratio of debt to cashflows or EBITDA (earnings before interest, taxes, depreciation, and amortization). This time leverage hasn’t declined because the weak companies remain due to Fed interference.

The median Debt/EBITDA of the market reached 4.1x at the end of 2020 or nearly double the 2014 leverage levels. You can see that the weakest 25% of issuers have a median leverage of 14.4x. The “zombies” are still alive, subsisting on government handouts and interest rates suppression.

We expect the junk bond market is mispricing the risk of default from these remaining weak companies. Basically you have all-time high levels of indebtedness combined with the all-time low level of yield from junk bonds. That is not an ideal combination.

This morning the Fed issued their report to congress. They chose to comment on this topic as well saying, “insolvency risks at small and medium-sized firms, as well as at larger firms, remain considerable.”

Instead of chasing a bad risk/reward situation in high yield corporate bonds, we’ve started evaluating private credit funds. The private credit markets offer a better mix of risk/reward. This is due to better payment terms for the lenders, higher interest rates, better collateral rights, and lower historical default rates. We’ll keep you updated on what we find.