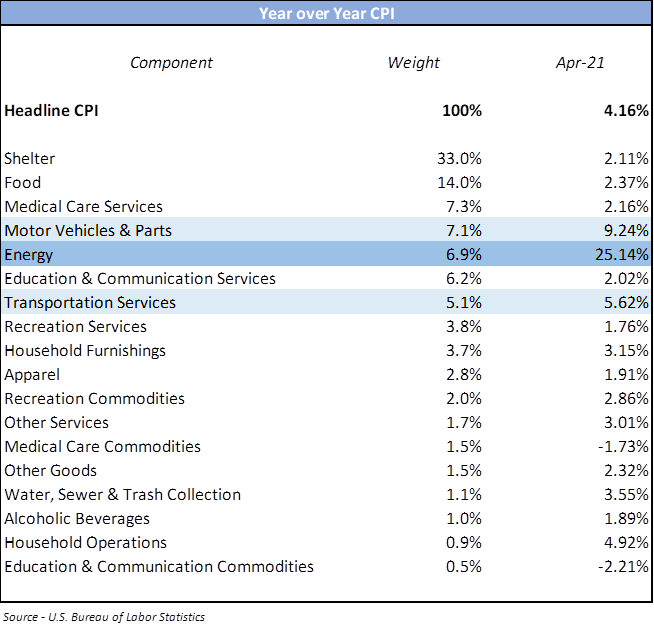

This week the Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI) calculation for April. Many looked at the headline inflation number of 4.16% and panicked. Stocks and bonds sold off in the first three days of the week as investors assumed that the feared inflation surge had finally arrived. This week we’ll dig into the details of the CPI number to show that April’s number is an outlier for inflation, not a new higher trend.

Shelter

The Shelter component includes the direct measurement of rents, a calculation of owner’s equivalent rent (a number that assesses what home owners would pay in rent for their homes) and lodging away from home (basically hotel rates). This category showed a 2.11% rate of change over the past year. Not a shocking number considering that the rate of change in April of 2020 was 2.6%. This number would have actually been lower excluding the large jump in hotel rates over the past year. Lodging away from home increased at an 8% rate.

Food

Food prices increased at a 2.37% rate over the last year. Given the huge supply chain disruptions in this category, that doesn’t seem like a bad number. However, if you dig into the details of this category the bulk of the increase in pricing is coming from restaurants coming back from lockdowns. Food prepared at home pricing was up only 1.2% with food away from home increasing at a 3.8% rate. Fast food prices were up 6.2%, as people have shifted from sit down dining to carry away options.

Medical Care Services

Medical care services continued their march higher but at a much slower rate than last year. Prices were up 2.16% in the last twelve months vs. up 5.8% in the previous year.

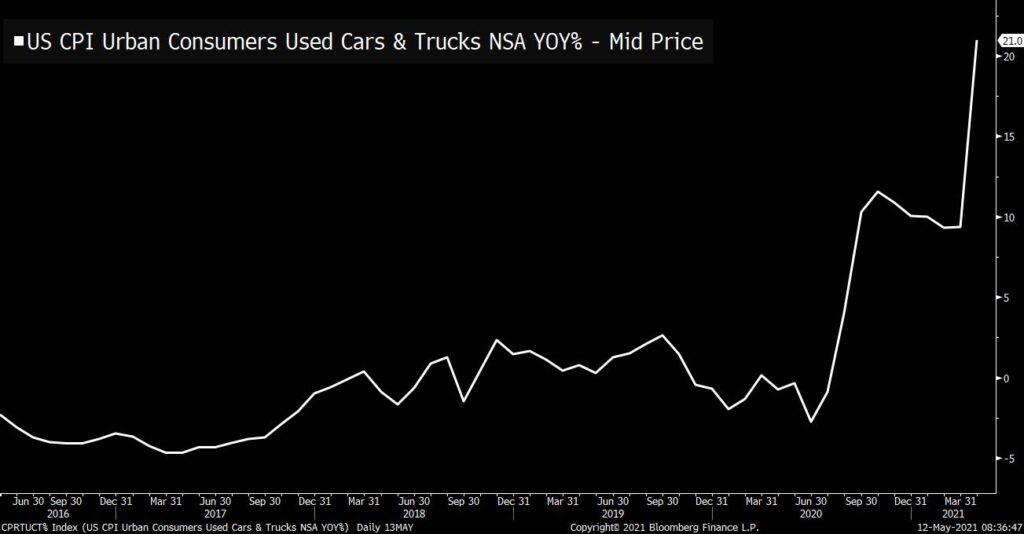

Motor Vehicles & Parts

Here we run into our first culprit for the unexpected surge in CPI in April. This category was up an enormous 9.24%. All of the price surge was driven by a massive increase in the price of used cars. Used car pricing increased by 21% over the year while new car pricing was up only 2%.

This is an aberration of the COVID shutdowns. Last year, new car production fell significantly as plants were forced to halt production due to shutdown orders and supply chain issues. Even today, the major car companies are taking down production guidance for this year due to lack of components in the supply chain. Combine a lack of new car availability and large stimulus distributions to households and the prices of used cars surged. This price surge is not a new trend and will be resolved as stimulus payments stop and car production resumes. It would be very dangerous to forecast perpetually higher inflation based on this one off surge in used car prices.

Energy

Energy prices increased by 25.14% over the period. This shouldn’t be a surprise to anyone. Oil has made a remarkably fast price recovery since the shutdown crash. Remember, that in April of 2020, the price of oil was actually negative—meaning people acquiring oil were being paid to take it. Of course, energy prices would be up a huge amount from that type of situation. When we first took a position in the energy space last year we laid out our case for oil getting back to $60 per barrel. That happened rather quickly so the CPI must account for the big surge in energy costs. However, oil prices are just back to normal levels and have been much higher at times in the past. Again, this is not a new trend of price increases but a return to normal as supply and demand balanced.

Transportation Services

This category includes items like car rentals, maintenance, insurance and public transportation. In the year ending April of 2020, this category was actually down nearly 6%. Since the peak of the lockdowns, this category has rebounded back to its previous levels. The category was up 5.62% over the last year.

The biggest components of insurance (+6.1%), public transport (+7.0%) and maintenance (+3.5%) drove the price increase. The insurance price increase is a function of the termination of rebates sent out last year. I got a rebate from my insurance company at this time last year because my miles driven had effectively fallen to zero. This also looks like a one-off issue to us and we don’t believe it will be repeated at this level going forward.

So the punch line is this month’s inflation number looks pretty high but it’s a function of a few categories with big anomalies. We still expect trend inflation to return to the 1.5% range after the stimulus payments are terminated and we work through the severe supply chain disruptions caused by last year’s lockdowns.